The importance of cyber Insurance in the hospitality sector is a topic that has gained significant attention in recent years.

With the rise of digital technology, hotels and other entities within the hospitality industry are increasingly reliant on online systems for reservations, payments, and guest services. While this has brought about efficiency and convenience, it has also opened doors to cyber threats such as hacking, data breaches, and ransomware attacks.

Cyber insurance serves as a critical safety net for hotels, providing financial protection against potential losses stemming from cyber incidents.

Unlike traditional insurance policies, cyber insurance is designed to cover the unique risks associated with digital operations.

It can include coverage for data restoration, legal fees, notification costs, and even reputational damage.

For hotels, a cyber attack can have devastating consequences. Sensitive guest information, financial data, and operational systems can be compromised, leading to significant financial losses and erosion of trust among customers.

Cyber insurance acts as a vital risk management tool, ensuring that hotels have the resources to respond to and recover from cyber incidents promptly.

In an era where cyber threats are evolving and becoming more sophisticated, having cyber insurance is no longer a luxury but a necessity for the hospitality sector.

It represents a proactive approach to cybersecurity, aligning with the industry’s commitment to guest safety and service excellence.

Types of cyber threats for hotels

Hotels, being part of the ever-growing hospitality industry, are exposed to various types of cyber threats that can have severe consequences.

Here’s a look at some common types:

- Data Breaches: Hotels collect vast amounts of personal and financial information from guests. Attackers may target this data, leading to unauthorized access and potential misuse.

- Ransomware Attacks: This involves malicious software that encrypts files, demanding a ransom for their release. Hotels’ critical systems can be locked, disrupting operations.

- Phishing Scams: Employees may receive fraudulent emails that appear legitimate, tricking them into revealing sensitive information or downloading malware.

- Point-of-Sale (POS) Attacks: Many hotels use POS systems for transactions. Hackers can target these systems to steal credit card information.

- Denial-of-Service (DoS) Attacks: These attacks overload the hotel’s online systems, making them unavailable. It can lead to loss of reservations and dissatisfaction among potential guests.

- Insider Threats: Sometimes, the threat comes from within, where disgruntled employees or contractors misuse their access to sensitive information.

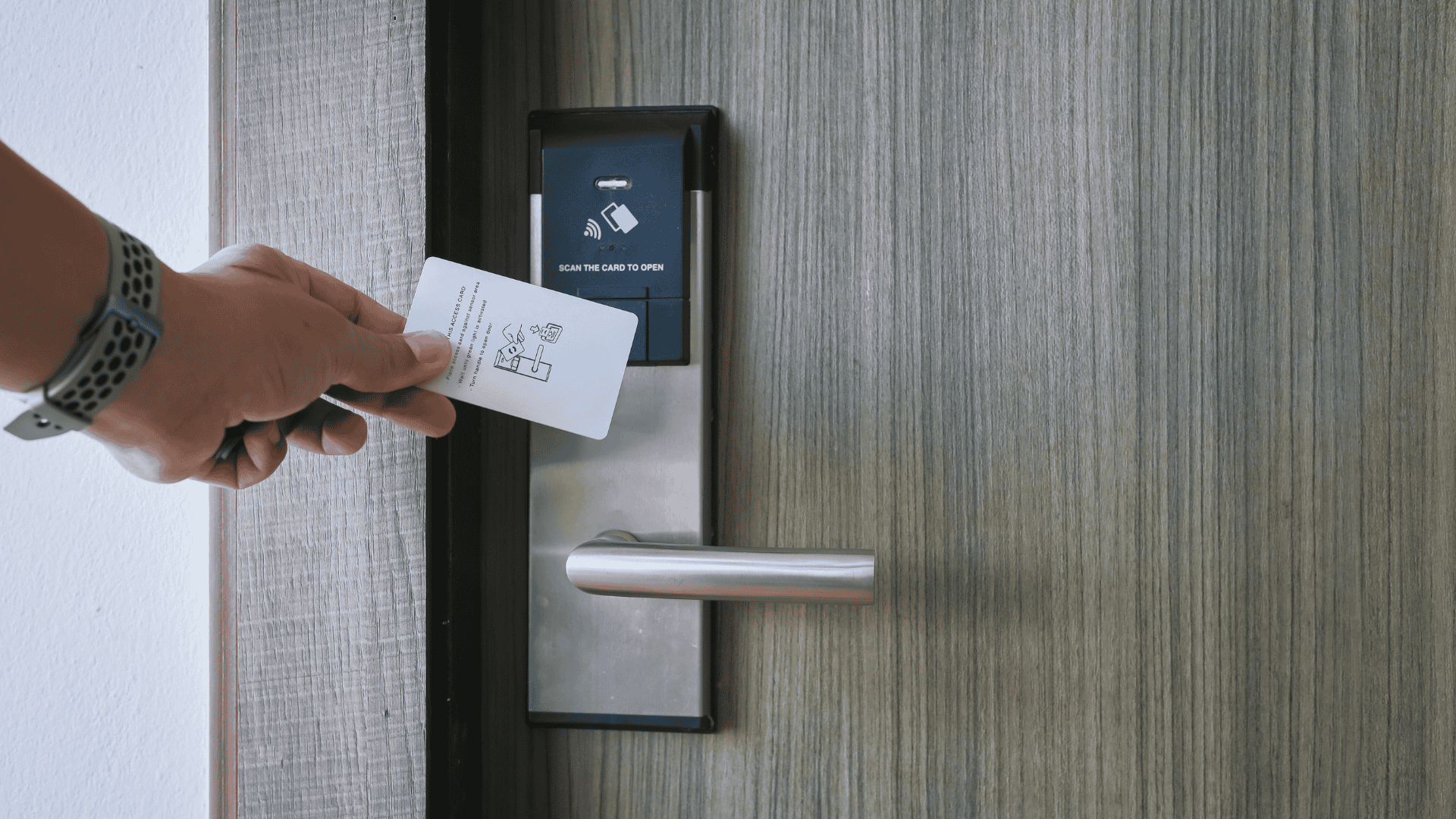

- IoT Vulnerabilities: Modern hotels use Internet of Things (IoT) devices for automation and convenience. Weak security in these devices can be exploited, providing a gateway to the hotel’s network.

Understanding these threats is the first step in creating a robust cybersecurity strategy for hotels.

Investing in proper security measures, regular training, and awareness among staff, along with cyber insurance, can mitigate the risks and protect both the hotel and its guests.

Case studies: cyber attacks on hotels and their impact

Here’s an overview of real-world cyber attacks on hotels, illustrating the significant impact they can have on the industry:

1. Marriott International (2018)

Attack Type: Data Breach

Impact: Personal information of approximately 500 million guests was exposed. The breach included names, addresses, phone numbers, email addresses, and passport numbers. The incident led to a significant loss of reputation and legal challenges, including hefty fines.

2. Trump Hotels (2016)

Attack Type: Point-of-Sale (POS) Attack

Impact: Credit card information of guests was stolen across 14 Trump Hotel properties. The breach lasted almost a year before detection, leading to financial losses and legal penalties.

3. MGM Resorts (2019)

Attack Type: Data Breach

Impact: Personal details of over 10.6 million guests were leaked online. The information included phone numbers, addresses, and emails. The incident raised serious concerns about the company’s data security measures.

The evolution of cyber insurance: from simple to complex

The journey of cyber insurance has been one of continuous evolution, mirroring the rapid changes in the digital landscape.

In its early days, cyber insurance was a simple add-on to existing policies, covering basic data breaches with limited scope.

As technology advanced and cyber threats became more sophisticated, the need for specialized insurance grew, leading to the development of standalone policies tailored to specific risks like ransomware attacks and identity theft.

Governments and regulatory bodies began to impose regulations and standards, making compliance a critical consideration.

This regulatory influence further shaped the complexity of cyber insurance, integrating risk management services such as cybersecurity assessments and continuous monitoring.

The market trended towards customization and segmentation, with policies designed for specific industries and types of risks.

Pricing and underwriting became increasingly challenging due to the complexity of cyber risks, requiring sophisticated models for accurate assessment.

The global expansion of cyber insurance reflected the international nature of cyber threats, necessitating cross-border policies and collaborations.

New technological risks emerged, such as IoT vulnerabilities and cloud security challenges, requiring further adaptation.

The future of cyber insurance is likely to see even more complexity, with innovations like artificial intelligence in risk assessment and blockchain for secure transactions.

The ongoing collaboration between various stakeholders will be key to shaping this future, ensuring that cyber insurance remains responsive and resilient in the face of ever-changing cyber threats.

The evolution from simplicity to complexity in cyber insurance is a testament to a maturing market that recognizes the multifaceted nature of cyber risks in our interconnected world.

Choosing the right insurance policy: 10 factors to consider

Choosing the right cyber insurance policy is crucial.

Here are some key factors to consider when selecting a policy that best fits the needs of a hotel or hospitality business:

1. Coverage Scope:

Understand what the policy covers. Does it include both first-party (your business) and third-party (customers and partners) coverage? Look for policies that cover data breaches, ransomware attacks, business interruption, and other relevant risks.

2. Exclusions:

Be aware of what is not covered. Some policies may exclude specific types of attacks or incidents, such as insider threats. Knowing these exclusions helps in making an informed decision.

3. Policy Limits and Deductibles:

Assess the policy limits and deductibles that align with your risk profile. Consider the potential financial impact of a cyber incident on your business and choose limits accordingly.

4. Compliance Requirements:

Ensure that the policy complies with legal and regulatory requirements specific to your location and industry. This includes adherence to data protection laws and industry standards.

5. Incident Response Support:

Look for policies that offer support in the event of a cyber incident. This may include access to cybersecurity experts, legal counsel, and public relations support to manage the aftermath of an attack.

6. Premium Costs:

Evaluate the cost of the policy against the coverage provided. While cost is a factor, it should not be the sole determinant. A cheaper policy may not provide adequate protection.

7. Insurance Provider’s Reputation:

Research the insurer’s reputation in handling cyber claims. Look for reviews, testimonials, and consult with industry peers if possible.

8. Customization:

Consider policies that can be tailored to your specific needs. The hospitality sector has unique risks, and a one-size-fits-all policy may not be sufficient.

9. Regular Review and Updates:

Cyber threats are constantly changing, and so should your policy. Ensure that there is flexibility to update the policy as risks evolve.

10. Risk Assessment and Mitigation Support:

Some insurers offer risk assessment tools and support in implementing preventive measures. Utilizing these services can enhance your cybersecurity posture.

By carefully considering the above factors, businesses can select a policy that provides robust protection against the multifaceted cyber risks they face. Engaging with a knowledgeable insurance broker or consultant who understands the unique challenges of the industry can further aid in making the right choice.

Building a resilient and secure hotel

In an era where digital transformation is at the forefront of the hospitality industry, the importance of cyber insurance cannot be overstated.

Hotels, being repositories of sensitive customer information and integral parts of the global travel ecosystem, are prime targets for cybercriminals.

Building a resilient and secure hotel is no longer just about physical safety; it’s about safeguarding digital assets as well.

Cyber insurance acts as a safety net, providing financial support and expert assistance in the event of a cyber incident.

It’s not just about recovering from an attack; it’s about proactive risk management, continuous monitoring, and fostering a culture of cybersecurity awareness among staff.

The journey from simplicity to complexity in cyber insurance reflects the evolving nature of cyber threats.

What started as basic coverage against data breaches has now expanded to include various aspects like third-party vendor risks, regulatory compliance, and tailored policies for specific threats. Choosing the right cyber insurance policy requires understanding the unique needs and risks of the hotel industry.

It involves collaboration with legal experts, cybersecurity professionals, and insurance providers to craft a policy that aligns with the hotel’s strategic goals.

In conclusion, cyber insurance is not a luxury but a necessity for hotels in today’s interconnected world.

It’s an investment in resilience, a commitment to customer trust, and a step towards a more secure future.

By embracing cyber insurance, hotels can navigate the complex digital landscape with confidence, knowing that they are prepared to face whatever challenges come their way.

Building a resilient and secure hotel is not just a goal; it’s a continuous process that requires diligence, foresight, and the right tools, including a robust cyber insurance policy.

The future of the hospitality industry depends on it.